In 2024, Tunisia emerged as a significant player in the Middle East and Africa’s fintech sector, poised as a cultural and technological bridge across Francophone, Arab and African regions

Capital and financial hub

Tunis

Key economic development strategy

Tunisia Digital 2021-2025

Economic, financial services and fintech overview:

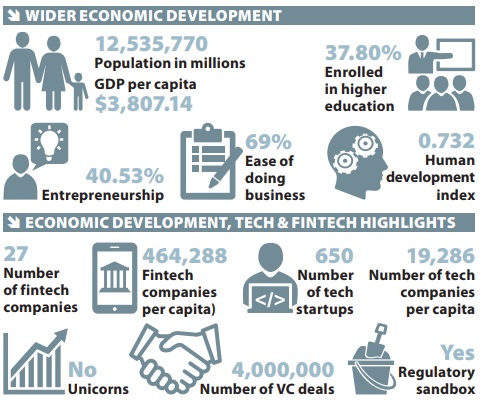

Tunisia, straddling Francophone, Arab North African, and African cultures, holds the potential to serve as a gateway across these diverse regions in the MEA.

Despite facing various challenges, ranging from economic to political to security issues, the country has made strides in advancing its technological landscape and also remains relatively stable and developed compared to its peers.

The Tunisian government has taken proactive steps to nurture a thriving startup ecosystem and enhance digital infrastructure, recognising entrepreneurship as a catalyst for economic growth. Initiatives like the Digital Tunisia 2020 strategy and the passage of the Startup Act demonstrate Tunisia’s commitment to prioritising digital transformation.

However, the regulatory environment in Tunisia appears to be heavily regulated, posing potential barriers to the future facilitation as well as growth of the broader startup community. In 2019, less than 40 per cent of Tunisians aged 15 and over had a bank account, below the Middle East and North Africa (MENA) average, indicating limited access to formal financial services. Cash also remains prevalent in the country, with only eight per cent of the population owning credit cards, lower than the regional average.

Digitalisation

Despite these challenges, Tunisia’s postal service, La Poste, has emerged as a popular provider of fintech products, serving over six million individuals with financial accounts. The country shows promise for further digitalisation, boasting a mobile connection rate exceeding 150 per cent of its population and a significant internet user base of 66.7 per cent.

Nevertheless, improvements are needed, as indicated by the dissatisfaction among Tunisian fintechs regarding the national regulatory framework. Over half of Tunisian fintechs perceive the regulatory environment as discouraging, highlighting the need for reforms to foster a more conducive ecosystem for innovation.

Among the fintechs operating in Tunisia are Bitaka (offering mobile transfer services), Kaoun (providing financial software solutions), and Paymee (offering payments processing solutions).

Breakdown of sector:

The country hopes to become a pioneer by implanting blockchain in the TCB, digital payment, and cryptocurrencies, according to the declarations of the governor of the TCB.

Key organisations:

- Banque Centrale de Tunisie – Central Bank of Tunisia (BCT)

- Conseil du Marché Financier

- Startup Tunisia

- Entrepreneurs of Tunisia

- Tunisia Investment Authority

- FintechTunisia

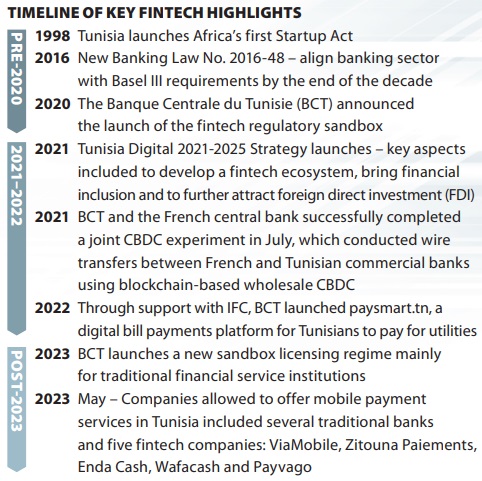

Timeline of key fintech highlights:

- 1998 Tunisia launches Africa’s first Startup Act

- 2016 New Banking Law No. 2016-48 – align banking sector with Basel III requirements by the end of the decade

- 2020 The Banque Centrale du Tunisie (BCT) announced the launch of the fintech regulatory sandbox

- 2021 Tunisia Digital 2021-2025 Strategy launches – key aspects included to develop a fintech ecosystem, bring financial inclusion and to further attract foreign direct investment (FDI)

- 2021 BCT and the French central bank successfully completed a joint CBDC experiment in July, which conducted wire transfers between French and Tunisian commercial banks using blockchain-based wholesale CBDC

- 2022 Through support with IFC, BCT launched paysmart.tn, a digital bill payments platform for Tunisians to pay for utilities

Key statistics of the country:

This article is an excerpt from Tech Finance Daily: Middle East and Africa (MEA) 2024 Report.